Safeco® Manufactured Home Insurance Quotes 833 772-3326

Table of Content

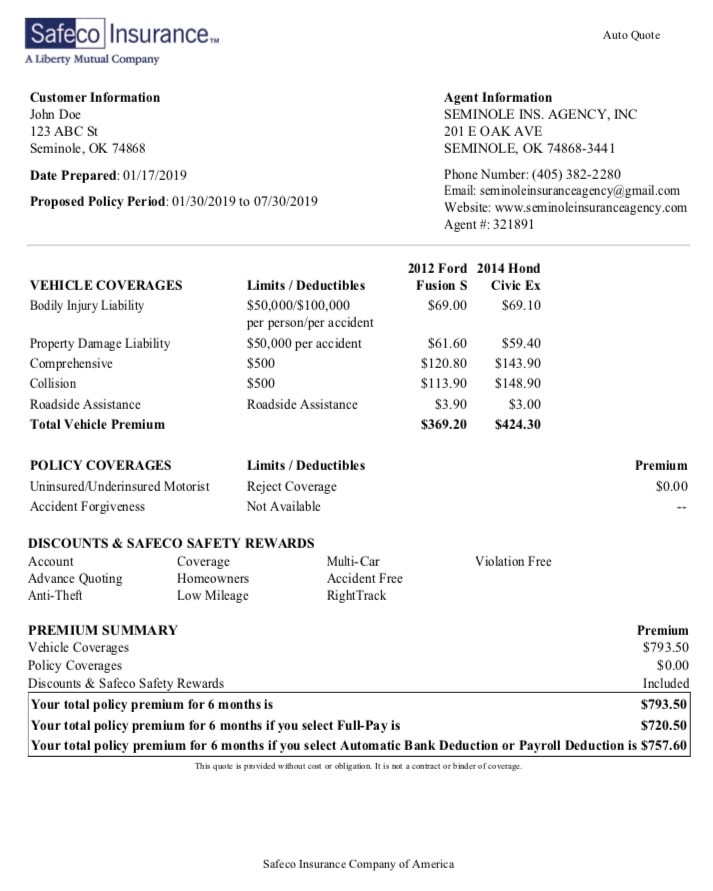

The calculations for the estimated premiums given in the table below are influenced by common factors that most insurance companies use to decide a quote. The factors include the ones we mentioned before, as well as the crime rate in your neighborhood, condition of your home, and credit score. We applied a combination of conditions to calculate the coverage amount and annual premium. They offer a wide range of insurance coverage plans and their customers enjoy many discounts and customization options.

Find out through their mobile app or website if your desired insurance coverage is available in your state. Sure McRent should provide sufficient documents that you can claim your costs to a third party insurance. But also this insurance company should not abuse you as a man in the middle. If they assume abuse/fraud by the rental company they should not punish you for this. Normally insurance companies have partner organisations abroad where they can get assistance with tricky/suspicious cases. However, on websites that use exclusively reviews from customers to generate a rating, the home insurance provider ranks very poorly.

Similar apps

Janet Hunt is an expert in car insurance, homeowners insurance, and health insurance with over 20 years of experience covering trends, regulations, and writing company reviews. Her lengthy career in insurance includes stints in customer service and selling personal lines of insurance. Progressive home insurance doesn’t sell their own home insurance coverage, but Safeco does and sells it through one of their independent agents. Power survey, both home insurance providers scored lower than other home insurance providers.

Safeco also offers a blog that has a fairly deep library of articles, including many specific to homeowners insurance. Safeco Insurance is one of the most affordable home insurance companies on the market, but you can find even more affordable ones. How affordable is Safeco depends on certain factors as well and the types of discounts you choose. Most customers don’t rate the home insurance provider well for their unsatisfactory method of handling and settling claims. Supporting the complaints of customers is the low score given to them by the prominent review platform, J.D.

Company Information

Power rating of 3.56 out of 5 based on consumer experience, billing and ease of use. This data suggest that Safeco, with a chance for improvement, is still successful when it comes to rewarding customers with quality service. Safeco is a competitive and reliable insurer, with an overall MoneyGeek rating of 87 out of 100 for its customer satisfaction, financial stability, and affordability.

Safeco offers a few discounts to help lower the amount you pay for homeowners insurance—fewer than many of its competitors. Safeco offers decent home insurance coverage through Liberty Mutual but only offers a few endorsements and discounts. Insurance deductible option for anyone who bundles home insurance with other Safeco policies.

Home Insurance Coverage Options

Multiple features such as addressing your customer complaints can be made with the app. Talk to your agents via voice or video call with the Safeco mobile application, downloadable on their website. The Safeco mobile insurance application is only available to policyholders of Safeco Insurance. Get the Safeco mobile app, your one-stop insurance resource. Log in fast and securely with Touch ID or Face ID. Access ID cards with one touch. Apart from offering the home insurance coverage option, you can purchase auto insurance, RV, identity restoration, pet insurance, condo, renters, and umbrella insurance.

To share feedback or ask a question about this article, send a note to our Reviews Team You can get a Safeco home insurance quote through its website or by calling a representative. Getting a quote and enrolling in a new policy before your existing policy expires. Covers legal expenses and damages if you're responsible for injuries to other people or their property. Pays to repair or replace personal belongings such as furniture or clothing. Safeco's service line coverage protects the underground utility lines that bring water, power and communication to your home, with coverage up to $12,000 and a deductible of just $500.

Ease of Buying and Claims Handling

Safeco offers a wide variety of insurance coverages for your home, so you can be sure to find a policy that fits both your needs and your budget. Local agents can help you find the perfect policy for your home through their website, Safeco Insurance. Safeco scores fairly well in balance sheet strength, operation performance, business profile and security, with an AM Best score of A. Safeco has a customer complaint score of 1.2 obtained through The National Association of Insurance Commissioners data.

If you insure more than one pet, you become eligible for a 10% discount. Thousands of Safeco policyholders have taken advantage of the mobile application feature available and may find it handy to use. Safeco Insurance offers multiple coverage options, but limited discounts. Past customers have less than stellar things to say about the home insurance company. The website offers features such as viewing recent account activity, getting documents related to your policy, filing a claim and canceling your policy.

The company, founded in 1923 by Hawthorne K. Dent, is a member of the Liberty Mutual Group, which is the fourth largest property and casualty insurer in the nation. Reimbursement for money spent recovering from identity theft. The waiting times for this flight have not yet been determined or are not available. Please try again later or refer to the information boards at the airport.

With more than 1,000 independent agents spread across the United States, the home insurance provider caters to 46 states. In addition to homeowners insurance, Safeco offers condo, landlord, and home warranty insurance. The This Old HouseReviews team is committed to providing comprehensive and unbiased reviews to our readers. This means earning your trust through transparency and having the data to back up our ratings and recommendations. Safeco is not accredited by the Better Business Bureau but holds an A+ rating from the organization.

When shopping for homeowners insurance, it’s important that you are getting all of the standard coverages. Often time standard policies exclude coverage for floods, earthquakes, or pest damage. If you need any of these coverages, you should double-check if your policies offer them or if you can get them as an endorsement or separate policy. Purchasing insurance for your home greatly depends on your circumstances.

Comments

Post a Comment